TRANSFER PRICING UAE

Transfer Pricing Advisory Services UAE

TRANSFER PRICING UAE

Transfer Pricing Advisory Services UAE

Transfer Pricing Regulation in the UAE

Introduction of Corporate Tax Regime in the UAE effective from 1st June 2023, will also introduce Transfer Pricing Regulation, which will mandate related party transactions to be at arm’s length.

The United Arab Emirates (“UAE”) joined the OECD Inclusive Framework on Base Erosion and Profit Shifting (“BEPS”) on 16 May 2018.

By joining the Inclusive Framework, the UAE has committed to implementing BEPS minimum standards, one of which is Transfer Pricing Documentation and Country-by-Country Reporting (“CbCR”).

What is Transfer Pricing?

“Transfer Pricing”, refers to the price at which two related parties transact. In a tax environment, such a transaction is undertaken between two associated enterprises and is often referred to as a “Controlled” transaction. Therefore, we can say that “Transfer Prices” are the prices at which an enterprise transfers-

- Physical goods

- Intangibles or

- Provide services to associated enterprises

Transfer pricing is the term used to refer to all pricing arrangements between related parties.

On the contrary, when one independent/unrelated party transacts with another independent/unrelated party, the transaction value represents “Transfer Price”. Such Transfer Price is regarded as “Arm’s Length Price” as the same is ordinarily driven by open market factors. In a tax environment, such a transaction is often referred to as an “Uncontrolled” transaction.

Why Transfer Pricing:

Transfer Pricing provisions come into play under the following circumstances:

When business is divided into more departments or divisions in the same country and;

- Management requires identifying activities of the business that generate value.

- A division of the group provides services or transfers goods to another division of the same company, and the profitability of each division is required to be determined;

In the case of cross-border transactions:

- When transactions whether relating to tangible goods, services, finance, or intellectual property take place between entities under common ownership and control

Transfer Pricing Advisory Services UAE

Transfer Pricing

SPS Management Consultancies Co LLC – Transfer Pricing Advisory Services in Dubai, UAE.

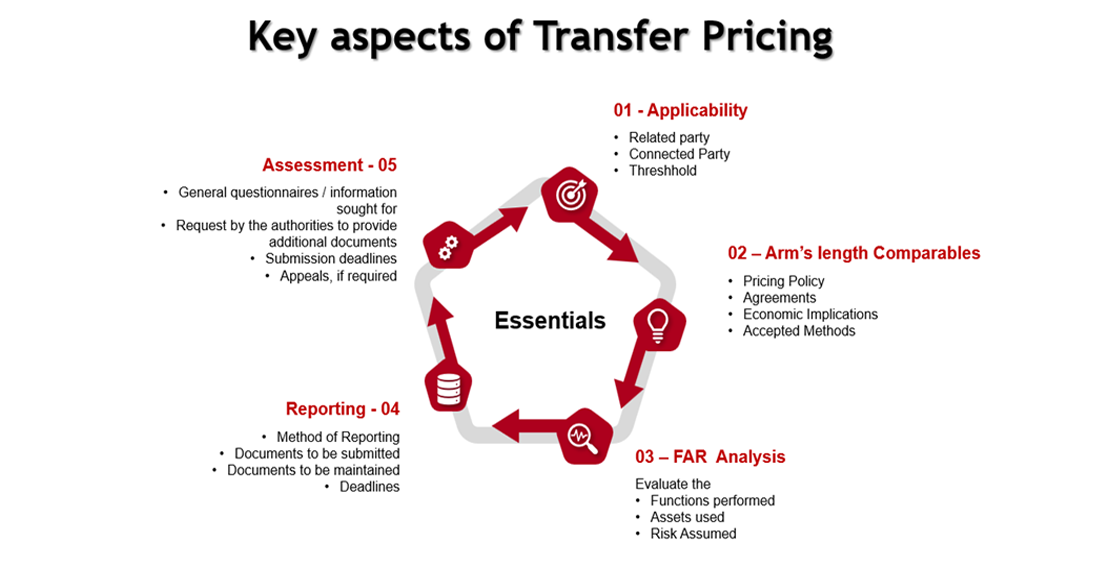

To whom UAE Transfer Pricing Regulations is applicable?

The proposed Corporate Tax Regime in the UAE vide release of Public Consultation Document inter-alia introduce Transfer Pricing rules to ensure that the price of a transaction is not influenced by the relationship between the parties involved.

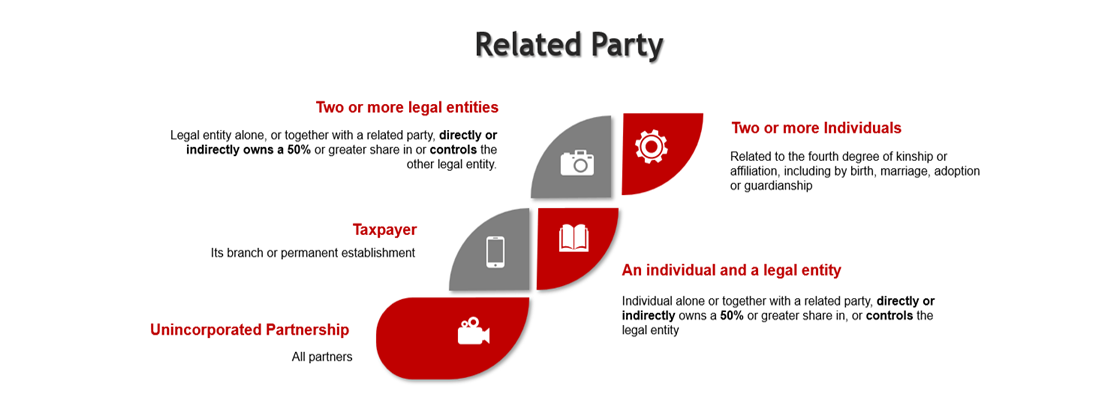

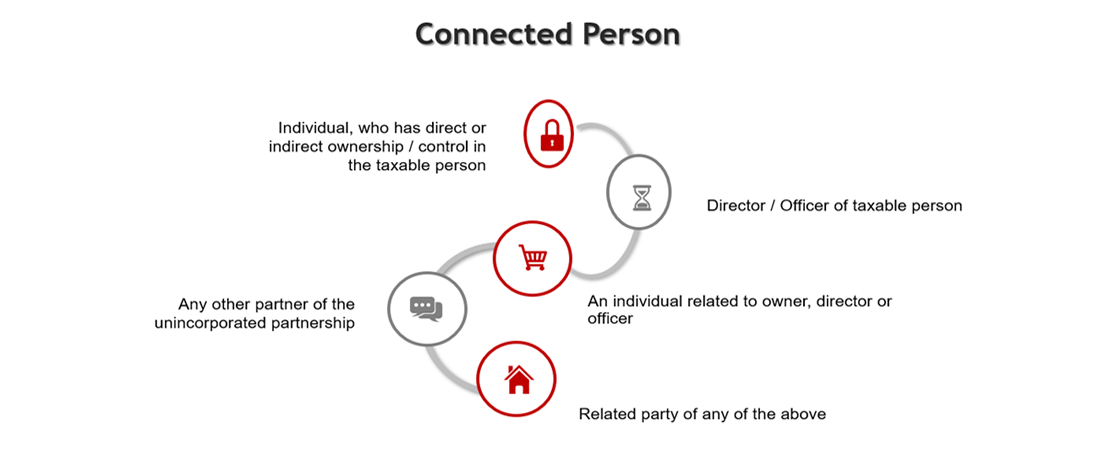

The Proposed CT regime requires ‘Arm’s Length’ principle to transactions between “Related Parties” and with “Connected Persons”.

How Can We Help You?

Our team brings vast experience to help you to manage your organization’s Transfer Pricing risk by delivering excellent Transfer Pricing assistance in a cost-conscious manner.

We are equipped to provide customized services in all the areas of Transfer Pricing, whether it is designing and planning your supply chain or ensuring accurate documentation to comply with Transfer Pricing Regulations in the UAE. Our experts shall be there to guide you on all the challenges faced while complying with these regulations.

High Impact Assessment:

- Understand the legal structure of the entity and the group at large

- Analysis of existing intergroup transactions

- Evaluating the applicability of Transfer Pricing Regulations

- Suggest a modification to existing Transfer Pricing policies in compliance with the proposed Corporate Tax law

- Assessing the impact of Transfer Pricing policies on their overall tax position

- Review whether any change

Advisory:

We can advise and assist you in all your queries regarding TP and ensure that the policies are robust and aligned to value creation or designing of new prices or the review of your current policies. We can also undertake the following assignments: –

- Help in developing and implementing efficient Transfer Pricing policies to optimize tax planning, considering the regulations of the Countries involved in the transaction.

- Assistance in determining the value of the transaction to arrive at arm’s length price Benchmarking Studies: – Conducting FAR analysis (including Functions, Assets, and Risks Analysis) – Performing economic analysis

- Implementation of Transfer Pricing policies

- Tax efficient restructuring of Supply Chain

- Carrying due diligence review to identify potential risks in adherence to Transfer Pricing regulation and documentation

- Creating tools and methodologies to keep track of the Transfer Pricing results.

- Conducting awareness session highlighting the aspects of Transfer Pricing

Documentation/Reporting:

Documentation is a crucial part of TP Regulations. They help in demonstrating that intercompany transactions are undertaken at an arm’s length price.

We provide you the following services to ensure you are compliant with all the regulations of Transfer Pricing in the UAE.

On Approval of the Audit plan, fieldwork is executed by performing a walk-through, inquiry, questionnaire, etc. Clients are kept informed of the audit process and the status of the audit.

Why SPS Management Consultancies Co LLC for Transfer Pricing in the UAE?

Our team brings vast experience to help you to manage your organization’s Transfer Pricing risk by delivering excellent Transfer Pricing assistance in a cost-conscious manner.

Other Services We offer:

- Country by Country Reporting (CbCR)

- Transfer Pricing – Compliance (Local File & Master File)

- Transfer Pricing – Advisory

TRANSFER PRICING -FAQ

People usually ask